The Bureau of Internal Revenue (BIR) has announced that business taxpayers would no longer pay the mandated ₱500 registration fee this year.

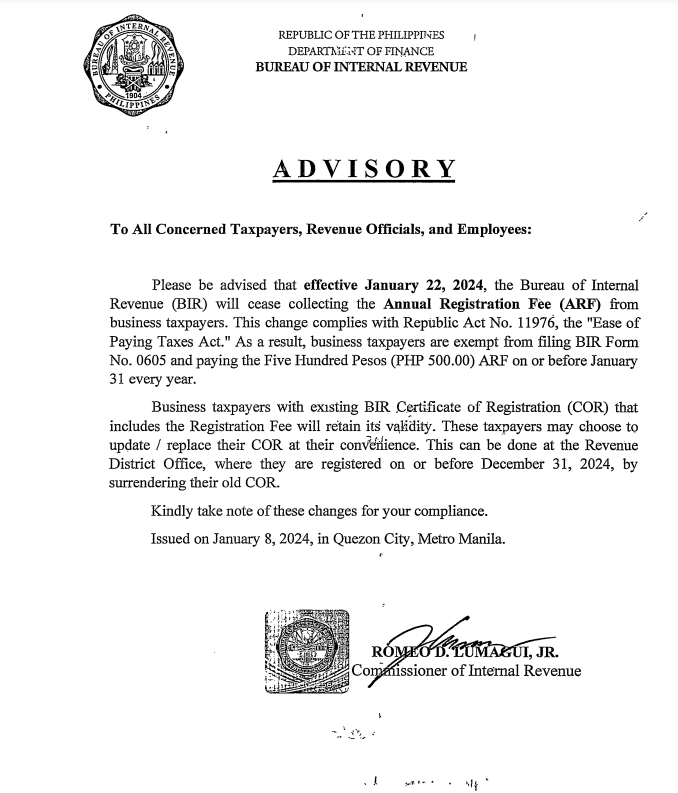

In an advisory issued on January 8, BIR Commissioner Romeo Lumagui Jr. said the new policy would take effect starting January 22.

"[B]usiness taxpayers are exempt from filing BIR Form No. 0605 and paying Five Hundred Pesos (PHP 500.00) ARF or before January 31 every year," he stated.

Lumagui said the BIR Certificate of Registration possessed by business taxpayers shall remain valid and this could be updated or replaced at their own convenience at the Revenue District Office.

Photo courtesy: BIR website

The directive comes after President Ferdinand 'Bongbong' Marcos Jr. signed Republic Act (RA) No. 11976 or the "Ease of Paying Taxes Act".

RA No. 11976 introduced administrative tax reforms and amended at least 40 sections under the National Internal Revenue Code of 1997.

The act also repealed Section 34 (K) of the National Internal Revenue Code of 1997.